“Today’s filing marks an important milestone in the process of establishing Kontoor Brands as an independent company,” said Scott Baxter, named CEO of Kontoor Brands. “As we prepare for life as a separate, publicly traded organization, I am confident that Kontoor Brands is strongly positioned to thrive as a leader in the global apparel industry and deliver long-term value for all of our stakeholders.”

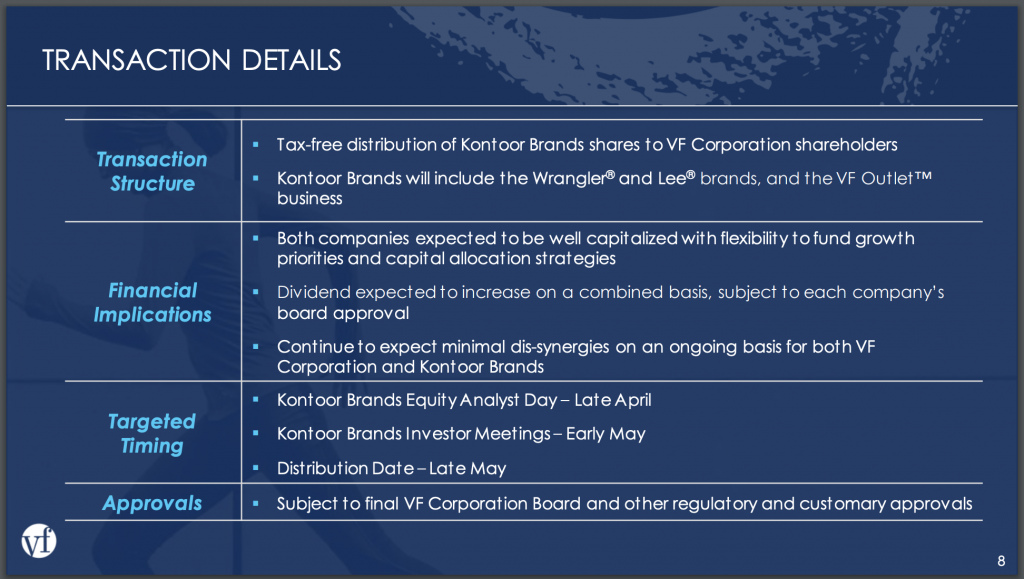

VF also released a presentation on the Kontoor spinoff transaction. The transaction, which is expected to be tax-free to shareholders, will separate the slower growing denim business from VF’s faster growing businesses.

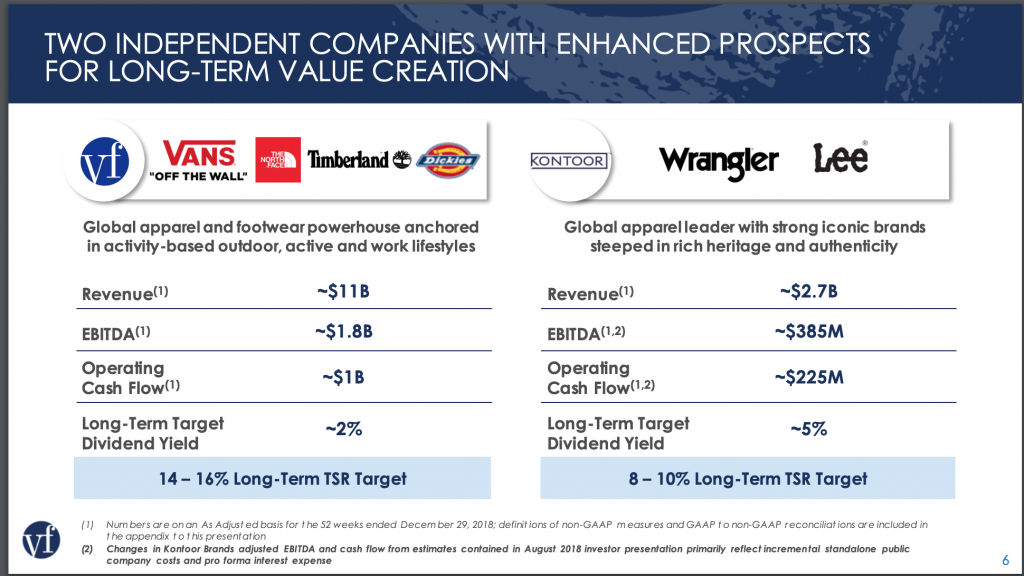

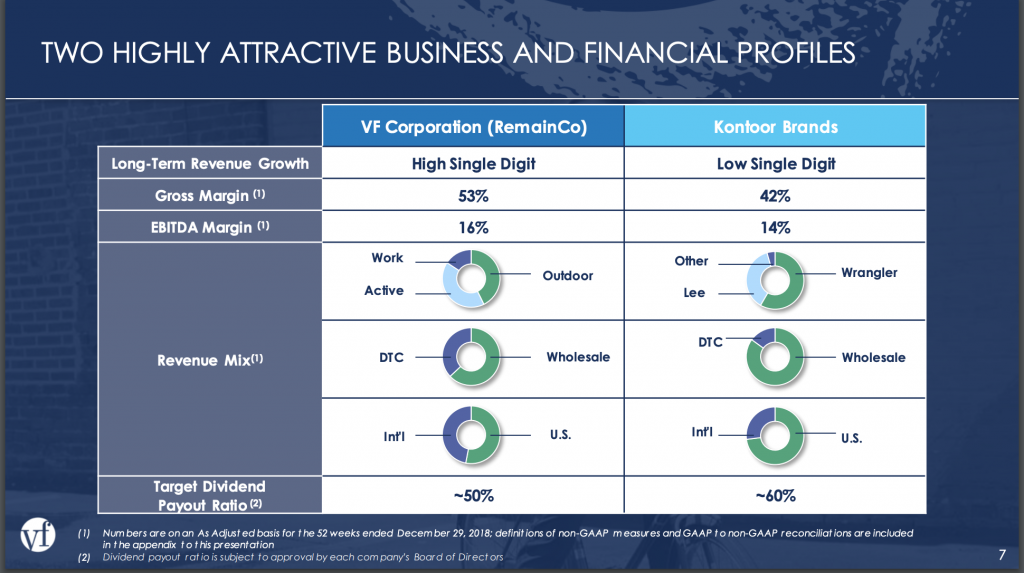

VF Corp will deliver $1.8 billion in EBITDA on $11 billion in annual revenue. It aims for a 2% dividend yield. Kontoor will have $385 million in EBITDA on $2.7 billion in annual revenue, but aim for a higher 5% dividend yield. Both companies should have significant operating cash flow.

We had to include this next slide, just to highlight the use of the “word” dis-synergies. We know they didn’t coin it, but it’s awful. Can we all agree to stop using it?

The rest of the presentation goes into detail on VF Corp and Kontoor Brands. Both companies appear worthy of further study, with reasonable financials and future prospects. TheStreet.com points out that the performance of newly public Levi Strauss(LEVI) bodes well for Kontoor Brands. Sourcing Journal provides their own summary on the filings, with, as you might expect, a little more focus on sourcing.

Unlike many of the spinoffs we look at, neither the parent nor the child seem to be struggling, and this does not appear to be an attempt to deleverage or improve one balance sheet at the expense of the other. These are just two profitable companies with different growth profiles. Investors in each are likely to be rewarded.

Disclosure: The author holds no position in any stock mentioned