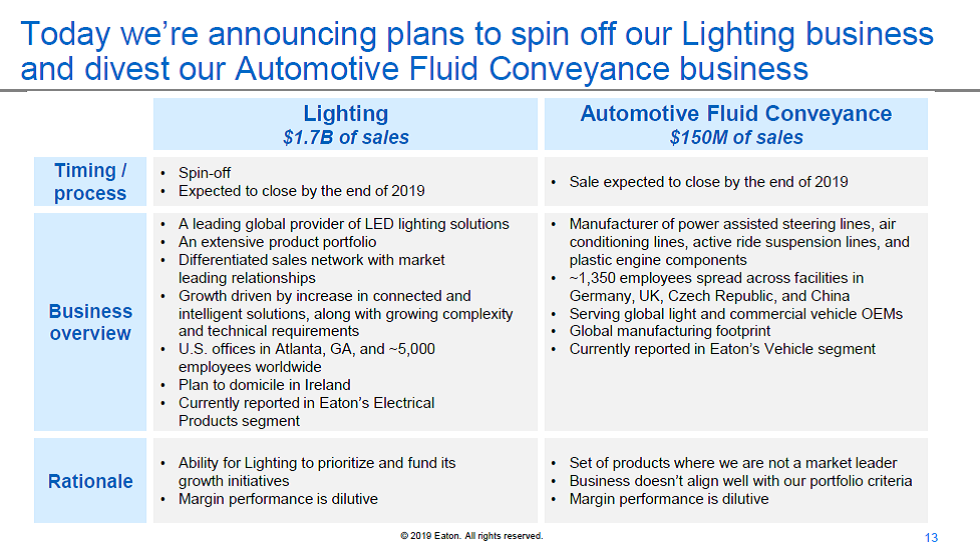

The Lighting business is one of the world’s leading providers of LED lighting and control solutions. Its broad range of innovative products and systems are designed to maximize performance and energy efficiency. The business, which had sales of $1.7 billion in 2018, serves customers in commercial, industrial, residential and municipal markets.

Sounds good, but why the spinoff? Eaton actually lays out the criteria against which all of its businesses are judged and unfortunately, lighting just doesn’t make the cut. For some specifics on the ‘criteria’:

and here is what the company says about the lighting business:

Basically, good business, but not good enough to be a part of Eaton, mainly due to the margins. This was spelled out more clearly numerous times verbally during the conference. Here is one example from Chairman and CEO Craig Arnold:

So first for our Lighting business. It’s a good business. It’s a $1.7 billion business. It’s certainly a leader in North America LED solutions. We report it today as a part of our Electrical Products segment, and it offers really a very broad range of LED products. It’s got a strong network of agents and distributors. Really significant growth opportunity in and around controls and connected lighting technology. The business has some 5,000 employees, and we actually run it at just outside of Atlanta, Georgia. It’s a good business, but there are certainly a number of attributes about the business that say we think it would be a better stand-alone business than it would be as a part of Eaton as it thinks about investing in its own future, controlling its own destiny. And obviously, as we talked over the year, it’s certainly dilutive to our margins.

Ok, but why now? One reason why it may have held on to the business for this long is due to potential ‘severe’ tax liabilities stemming from its inversion deal many years ago. Back in 2014, then CEO Alex Cutler said that it couldn’t pursue a spinoff for five years since ‘any spinoff would result in a very significant tax liability.’ Mr. Cutler also noted that ‘this five-year prohibition means that there is not really a compelling economic rationale for further business portfolio transformation.’

Exactly five years have passed and Eaton is ready to jump right in with a strategy that already has been used several times. Readers of this site know that Eaton isn’t the first company to dump its slower growth and lower margin lighting business. GE sold its LED lighting business last year to a private equity firm and Phillips spun off Phillips Lighting back in 2016. Siemens started the lighting spinoff trend with its Osram spinoff back in 2013.

Eaton’s LED lighting business came as part of its 2012 acquisition of Cooper Industries and there was hope it would fit within its IoT/intelligent systems future. Unfortunately, it hasn’t been a great fit and performance has lagged other units. The remaining Eaton parent company is excited about its future and feels that its business will now be able to deliver strong results throughout the business cycle.

Eaton is pitching the tax free spin off as doing the right thing for shareholders and wants to set the company up for success. As an example, Eaton expects the new lighting company to be an investment grade company. Ultimately, those details will be finalized over the next six months or so. Given the recent acquisition of the lighting business, it’s possible that the tax benefits of the transaction may be minimal so a sale might ultimately make sense if a buyer emerges over the coming months. As always, we will keep you updated as more information is released.

Disclosure: Author holds no position in any stock mentioned.