📊 Key Deal Metrics & Structure

| Metric | Details |

|---|---|

| 2025 Pro Forma Sales | ~$6.5 B combined revenues |

| 2025 Pro Forma Adjusted EBITDA | ~$2.0 B |

| Synergy Targets | ~$200 M cost savings by Year 3; ~$290 M revenue synergies by Year 5; total ~$345 M EBITDA synergy by 2030 (Becton, Dickinson and Company) |

| Ownership Split | Waters shareholders ~60.8%; BD former unit/spun shares ~39.2% |

| Transaction Cash to BD | $4 billion (subject to working capital adjustments) |

| Incremental Debt | Waters takes on ~$4 billion of additional debt |

| Target Close | First half of 2026, after shareholder and regulatory approvals |

✅ What Makes This a Reverse Morris Trust?

At first glance, the Waters–BD deal doesn’t look like a Reverse Morris Trust (RMT)—after all, reports indicate Waters shareholders will own approximately 60.8% of the combined company, with BD shareholders receiving 39.2%. That would seemingly disqualify it from tax-free treatment under IRS rules.

But here’s the key: those numbers are preliminary and subject to automatic adjustment to ensure the transaction qualifies as a tax-free RMT.

So how does it work?

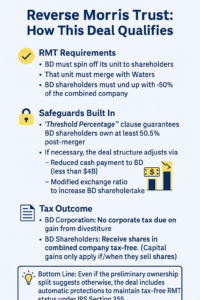

A Reverse Morris Trust allows a parent company (BD) to divest a business tax-free by:

- Spinning off the business to its own shareholders.

- Merging the spun-off entity with another company (Waters).

- Ensuring that BD’s shareholders own more than 50% of the voting stock and economic value of the combined company immediately after the merger.

This deal contains a “Threshold Percentage” provision (per BD and Waters’ filings), which requires that:

“The ownership of the combined company by BD shareholders must be at least 50.5%, otherwise the exchange ratio and/or cash consideration will be adjusted accordingly.”

In other words, if Waters’ value rises before closing or share price fluctuations push the ownership split out of compliance, the agreement allows for:

- A decrease in the $4 billion cash consideration paid to BD, and/or

- A change in the share exchange ratio to boost BD shareholders’ stake.

These built-in safeguards are standard practice in RMTs to protect their tax-free status.

👉 You can read more about the mechanics of RMTs in our past explainer:

What is a Reverse Morris Trust and When Is It Used?

🧪 Why It Matters — Strategy & Scale

- BD’s unit had ~$3.4 B in 2024 revenue with ~30% EBITDA margin (Becton, Dickinson and Company)

- Post-deal, the combined company will offer ~$6.5 B in pro forma revenues and ~$2.0 B in EBITDA in 2025 (Becton, Dickinson and Company)

- Investors anticipate mid- to high-single-digit revenue growth and mid-teens EPS growth through 2030 (Becton, Dickinson and Company)

Waters, originally founded in the basement of a police station in Framingham, MA, brings chromatography and mass-spec pedigree. BD adds flow cytometry, microbiology, PCR platforms—expanding reach into regulated clinical settings.

🏦 Debt & Shareholder Value

Waters’ $4 B new debt could elevate risk in a tightening funding environment. Still, the $4 B cash payment to BD strengthens its balance sheet, offering capital flexibility and a partial return of capital to shareholders. Post-deal, BD can double down on medtech areas like medical essentials and interventional systems.

💥 Starboard Pressure & Market Reaction

Activist hedge fund Starboard Value had pushed BD to divest its life sciences business. BD confirmed its separation strategy in February 2025 (Becton, Dickinson and Company); this RMT with Waters is the outcome. The announcement on July 14 pushed Waters shares down ~12% intraday, reflecting investor concern over debt and deal execution amid macro headwinds—despite pro forma revenue multiples (~5× 2025 revenues) appearing favorable (Reuters).

📌 The Takeaway

- Tax-efficient spin: Shareholders gain cash + equity without immediate taxes.

- Focused strategies: BD sharpens medtech profile; Waters scales up in clinical diagnostics.

- Financial balance: $4B cash inflow for BD; but Waters adds significant leverage.

- Outlook: Growth synergies and shareholder value hinges on integration and macro trends.

—

This deal isn’t just another corporate reshuffle—it’s a tax-savvy pivot, strategically crafted to generate long-term value. We’ll follow it as it progresses into 2026.

Disclosure: The author owns no position in any stock mentioned

Mentions