“The Board has violated a clear shareholder directive and disenfranchised shareholders,” Starboard wrote in a letter to Darden shareholders reviewed by The Wall Street Journal. “The announcement of the Red Lobster sale demonstrates that Darden’s current board does not regard upholding shareholder interests as a priority.”

Darden issued a weak defense of its decision to ignore the will of its owners

Starboard has made a big bet here, as this is its largest investment ever. It has gathered a team of top notch talent to form its new Board.

On the activist investor’s slate are several restaurant-industry executives, including a former executive from Darden’s Olive Garden and Alan Stillman, who founded TGI Friday’s, the people said. Two Starboard employees, founder Jeffrey Smith and managing member Peter Feld, are also on the list, the people said.

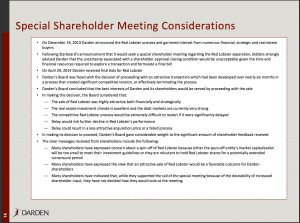

Friday, Darden announced the sale of Red Lobster to private-equity firm Golden Gate Capital for $2.1 billion. The company said it expects after taxes to collect $1.6 billion in proceeds, which would go toward paying down debt and maintaining its dividend.

Starboard had argued for a broader breakup to separate Olive Garden, LongHorn Steakhouse and Red Lobster and create a third publicly traded company for Darden’s real estate.

Darden shares have fallen 10% this year and 5% since Starboard’s position was first reported by The Wall Street Journal in December.

Since February, Starboard had been laying the groundwork for nominating a board slate by hiring four advisers from the restaurant industry, three of them former Darden executives. It paid each an upfront $50,000 fee that was to be used to buy shares of Darden, according to filings.

In February, the activist hired Bradley Blum, a former CEO of Burger King and one-time president of Olive Garden. The activist also hired Charles Sonsteby, the chief financial officer of craft store Michael’s Stores Inc. and a former CFO at Chili’s parent Brinker International Inc. Both are on the slate for the board, the people said.

So while it seems that the Red Lobster fight is the fish that got away, Starboard continues to aggressively fight this war. It is quite unusual for an activist to attempt to contest more than a few seats, but Starboard is going full in, to replace the entire Board. We believe that it is likely to ultimately win its prize of control. The only question is- what value will the prize have by the time it finally wrests it from the hands of an unresponsive management team?

Disclosure: The author holds no position in any stock mentioned