The GoTo family of service offerings delivers collaborative communication solutions for small and medium sized businesses and has strong global brand recognition through leading products including GoToAssist, GoToMeeting, GoToMyPC, GoToTraining, GoToWebinar, Grasshopper and OpenVoice. LogMeIn, a leading provider of cloud-based connectivity, has rapidly attracted millions of users and thousands of leading businesses to its popular and disruptive products, including join.me, LastPass, LogMeIn Rescue and BoldChat, among others.

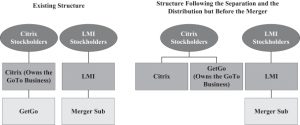

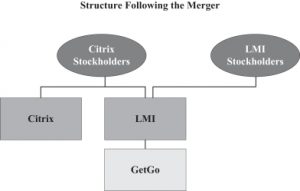

The Form 10 for the transaction can be found here. Interestingly, GetGo will have no indebtedness. In many Reverse Morris Trust transactions, the company being spun off will first borrow money and then pay a dividend to its soon-to-be-ex-parent. On a combined basis, the companies lost $38.8 million on $755 million in revenue through the first nine months of 2016. Interestingly, the negotiations between Citrix and LogMeIn were long and protracted and began even before Citrix announced plans for a spinoff in November 2015. The day after the announcement, Citrix instructed its advisors to negotiate a Reverse Morris Trust deal with LogMeIn. However, as late as June 10, 2016, discussions were discontinued and the deal was off. The pages long “Background of the Merger” section in the filing is a fascinating account of this topsy-turvy process.

Disclosure: The author holds no shares of any stock mentioned.

Likes

Mentions