Given its ubiquitous products and tremendous success, it isn’t surprising that everyone seems to have an opinion about Apple (AAPL). There are haters and fanboys and those in between, but all seem to get emotional when discussing the company’s products. Even the stock brings about heated conversations. One area of the company that has gotten a lot of attention over the past few years, quite publicly from Carl Icahn, is its giant cash pile. Although the company has been stepping up its share buybacks and enlarging its dividend, the pile just seems to keep on growing.

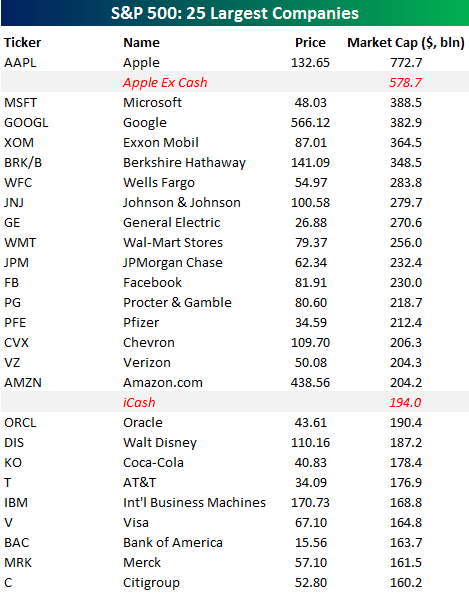

Just how big is it though? The short answer is BIG. For some perspective, following its most recent quarterly results, the Bespoke Investment Group pondered the question of what a spinoff of Apple’s cash and investments would actually look like. Obviously, this was just a fun exercise and not a real recommendation, but the results are truly wild:

Basically, ‘iCash’ would be the 17th largest company in the S&P 500, bigger than mega companies like IBM (IBM) and Disney (DIS). Thats right. A company of purely liquid securities bigger than Disney and so many others.

Wow.

Disclosure: Author owns shares of AAPL and DIS