While speaking at a recent Barclay’s Energy Conference, ConocoPhillips (COP) CEO Jim Mulva provided an update on the company’s broad strategic repositioning plan including some additional details on its upcoming spinoff (see our earlier article on the spin here).

The plan is to create a pure-play E&P company (retaining the Conoco name) along with a new downstream company. The spinoff company will also include COP’s chemical JV (with Chevron) and midstream JVs in an attempt to make it more ‘integrated’. Both companies are expected to have strong cash flow generation and will increase distributions to shareholders, a key selling point of the plan. As part of the transaction, the new company will have $8 billion in new debt, $6b of which will go to COP in order to reduce debt.

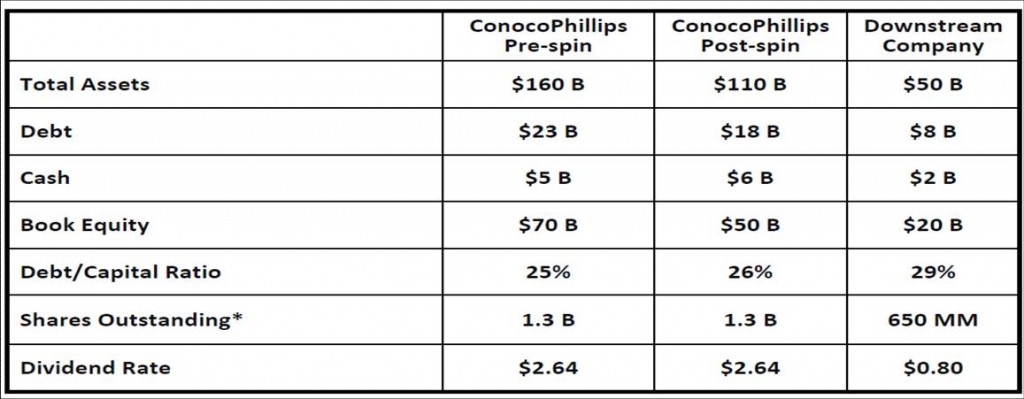

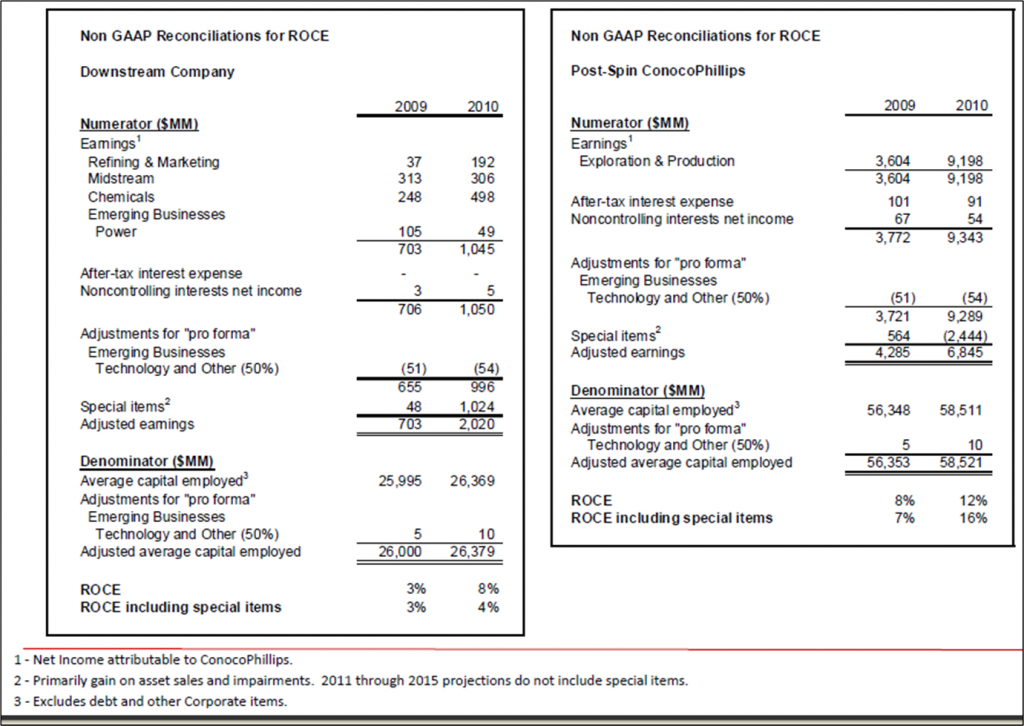

Here is a snapshot of the financial data for the companies post-spin taken from the presentation linked to above (which is loaded with info):

and some more:

The company also provided an update on the spin’s timeline. SEC filings are expected to be filed later this quarter and the spin is expected to be completed sometime during Q2 next year. COP shareholders will receive 1 share of the new company for every 2 COP shares owned. A transcript containing Mr. Mulva’s full remarks from the conference can be found here.

New management teams were just announced and the new CEOs of the upstream and downstream companies will be Ryan M. Lance and Greg C. Garland respectively. Mr. Mulva, the current CEO, will retire post-spin. Mr. Lance is currently an SVP with over 26 years of experience in the E&P business while Mr. Garland has experience as president of the Chevron Phillips Chemical JV (although he is also currently an SVP in the E&P business).

The repositioning plan is aggressive and the company has already sold off billions of ‘non-core’ assets including its interest in Lukoil. Many other companies have pursued this strategy to mixed results although COP is surely the largest. Not every company is convinced of its benefits though as Royal Dutch Shell (RDS-A) announced that it plans on keeping its ‘vital’ refining operations.

We will keep you updated as more information is released.

Disclosure: Author holds no position in any stock mentioned.